I’m celebrating. At the beginning of 2020, climate and energy journo Alessandro Vitelli (aka @CarbonReporter) held a competition on Twitter to see who could predict the price of a tonne of CO2e (carbon dioxide or equivalent) on the Intercontinental Exchange (ICE) Futures at the end of the year.

Specifically, he asked for a prediction for the 20th December EUA price when it expired on 14th December.

EUAs, short for European Union Allowances, are permits to emit greenhouse gases that are bought and sold as part of the European Union’s Emissions Trading Scheme. California runs a similar Cap-and-Trade Program.

Needless to say, prices in the marketplace can swing a fair amount compared to the more stable carbon pricing regime that Trudeau’s Liberals introduced in Canada, with its escalating ladder of carbon prices. Canada’s carbon price will rise each year to $170 per tonne of CO2e by 2030 from $30 now, to $40 in 2021, $50 in 2022 and then an additional $15 each year.

There are many variables that impact EUA price. For example, it wasn’t clear whether the UK would leave the EU ETS or set up its own ETS – it did the latter which was price positive for the EUA. Will there be less demand for permits due to economic slow-down? Will industry or nation states ratchet up de-carbonisation? How will political pressure impact issuance or retirement of allowances? And so on.

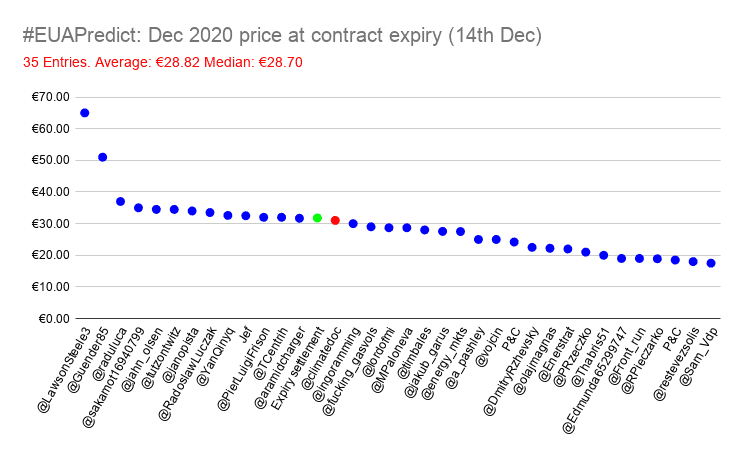

It’s a guessing game, particularly since the price swings can be huge. In the space of a year, the EUA price can easily plummet to half its value and then double. In 2018, the EUA price trebled. So imagine my surprise when my prediction won.

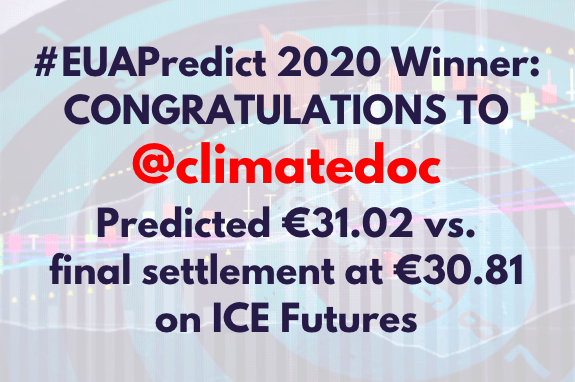

At the beginning of 2020 EUAs were trading at €24.90. I predicted €31.02. The actual price expired €0.21 lower at €30.81. (I used the Twitter account of my film Running On Climate, @climatedoc)

The prize: “the adulation of the masses and a healthy ego boost in time for Christmas.”

I’m making the most of it!

An uncanny convergence in carbon price

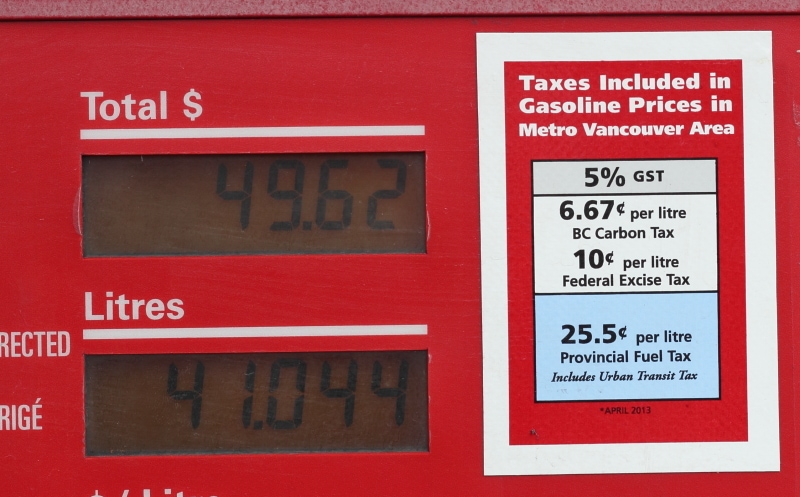

It’s almost uncanny, but if – back in January – I’d gone with the province of British Columbia’s 2020 carbon price I would have been even closer in my prediction.

The B.C. carbon tax was due to rise in April this year from $40 to $45. A year ago, EURCAD or €1 was $1.46 and so the 20th December 2020 EUA expiry price at €30.81 was virtually bang on $45 (30.81 x 1.46 = 44.98).

For a moment, both Europe and BC’s anticipated carbon price for 20 December 2020 were perfectly aligned.

But, the future is always being re-written. While BC’s carbon price is clearly laid out in legislation, it is always vulnerable to changes of heart among its political leaders.

BC Premier Gordon Campbell first introduced North America’s first carbon tax in a rush of climate-change-fighting zeal. The tax started in July 2008 at $10 per tonne and rose $5 a year to $30 in 2012. But then incoming BC Premier Christy Clark, more interested in clearing the way for potential LNG riches, froze the carbon tax for five years (2012 to 2017), allowing its impact to erode from inertia and inflation.

In 2017, with three BC Green MLAs now holding the balance of power in the legislature, the BC carbon tax found a new impetus. With Green support, Premier John Horgan’s minority NDP government reinstated the $5 annual carbon tax rises from $30.

The way seemed clear.

However, I didn’t know in January that the BC government would freeze the carbon tax for a year at its 2019 rate of $40 (it was due to go up in April).

Meanwhile, the federal carbon pricing regime started in 2019 with its floor or “backstop” on carbon prices nationwide marching upwards at a faster rate of $10 each year, from $20 to $50 by 2022.

The federal carbon price, and Covid-19, provided the cover for Horgan to put the brakes on the BC carbon tax for a year, just as he was calling a snap election in which he expected to win a majority. An election which would end his dependence on the BC Greens, who opposed the freeze and have been strong critics of his government’s push to build an LNG industry.

Horgan has said he plans to raise the BC carbon tax $5 to $45 in April 2021, and then align with the rest of Canada at the federal rate.

So the rest of Canada will have caught up with BC. Or BC slipped back, depending on how you look at it.

Of course, there’s a federal election due by the end of 2023. There’s also an imminent Supreme Court decision brought by some provinces on whether the federal carbon pricing regime is constitutional. The Court is expected to rule in favour of the federal government.

Lower loonie impact

So political risk is a key factor in the volatility of carbon prices. Currency swings are another.

Even if BC hadn’t frozen its carbon price, the fall over the year of the Canadian dollar against the Euro would have meant that BC and the EUETS did not end up as perfectly aligned by year’s end. With EURCAD at around 1.5481, the final December EUA settlement would have equated to $47.69 rather than $44.98. Still, $2.69 difference is pretty close.

For good measure, in my EUA prediction I also took a stab at 2020’s high and low. I forecast a high of €33.19 and low of €23.34.

It looks like the low is in for the year, at €14.34 in March during the pandemic market meltdown, so I was way off there. The EUA price is currently trading at its high for the year at €32.02, so not a long way off my forecast high for the year, with a few days left on the calendar.

With the weaker Canadian currency, it means that the price of carbon in Europe is now around $10 higher than the BC carbon price ($50 in Europe vs. BC’s $40) and $20 higher than Canada’s federal carbon “backstop” ($50 vs. $30). The Canadian carbon price increases $10 on 1st April 2021 to $40, $5 less than BC.

In the long term, the price of carbon around the world looks set to climb, given the urgency of the climate problem. How much correlation there is between the price of carbon in Canada and Europe, and how it might serve future EUA predictions in a sometimes wildly fluctuating market, I don’t know.

But as the above shows, even with economic and political variability, it’s striking how the price in these quite different carbon pricing regimes can converge.

Something to consider for my 2021 EUA prediction.